-

Thomas Jordan sees only small risk of inflation in the swiss economy - the Swiss newspaper Schweiz am Wochenende

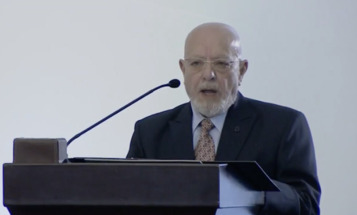

Swiss National Bank (SNB) Chairman Thomas Jordan gestures as he attends a news conference in Bern, Switzerland June 18, 2020. REUTERS/Arnd Wiegmann

By Reuters Staff

Swiss National Bank (SNB) Chairman Thomas Jordan sees only modest inflation risk in Switzerland as the central bank maintains cautious optimism for global economic recovery, he said in a newspaper interview published on Saturday.

“In Switzerland, we believe the inflation risk is modest,” Jordan said in the interview with Swiss newspaper Schweiz am Wochenende. “Until recently inflation here was even negative, meaning consumer prices were falling slightly, now it’s back in positive territory. The National Bank expects moderate inflation.”

Echoing remarks made on Tuesday, Jordan said the country’s economy was not overheating and its monetary policy “appropriate”.

“The strong currency also works to dampen inflation. The franc remains highly valued,” he said.

Since 2015 the SNB has charged an interest rate of minus 0.75% on the overnight deposits of commercial banks, and intervened in currency markets to keep a lid on the value of the safe-haven Swiss franc.

Jordan said the SNB hoped to one day come out of the phase of negative interest rates, but such policy remained necessary at the moment.

“It isn’t the case that we consider a situation of negative interest rates desirable; it’s quite the opposite,” he said.

“But in the current environment, without negative interest rates the franc’s value would increase markedly, which would massively harm our economy, associated with rising joblessness and negative inflation. That wouldn’t help anyone,” he added.

(Reporting by Brenna Hughes Neghaiwi; Editing by Kirsten Donovan)

Reuters, MAY 29, 2021/11:17 AM GMT

Image Ownership Reuters

You May Also Like

Popular Posts

Caricature

BENEFIT Sponsors BuildHer...

- April 23, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, has sponsored the BuildHer CityHack 2025 Hackathon, a two-day event spearheaded by the College of Engineering and Technology at the Royal University for Women (RUW).

Aimed at secondary school students, the event brought together a distinguished group of academic professionals and technology experts to mentor and inspire young participants.

More than 100 high school students from across the Kingdom of Bahrain took part in the hackathon, which featured an intensive programme of training workshops and hands-on sessions. These activities were tailored to enhance participants’ critical thinking, collaborative problem-solving, and team-building capabilities, while also encouraging the development of practical and sustainable solutions to contemporary challenges using modern technological tools.

BENEFIT’s Chief Executive Mr. Abdulwahed AlJanahi, commented: “Our support for this educational hackathon reflects our long-term strategic vision to nurture the talents of emerging national youth and empower the next generation of accomplished female leaders in technology. By fostering creativity and innovation, we aim to contribute meaningfully to Bahrain’s comprehensive development goals and align with the aspirations outlined in the Kingdom’s Vision 2030—an ambition in which BENEFIT plays a central role.”

Professor Riyadh Yousif Hamzah, President of the Royal University for Women, commented: “This initiative reflects our commitment to advancing women in STEM fields. We're cultivating a generation of creative, solution-driven female leaders who will drive national development. Our partnership with BENEFIT exemplifies the powerful synergy between academia and private sector in supporting educational innovation.”

Hanan Abdulla Hasan, Senior Manager, PR & Communication at BENEFIT, said: “We are honoured to collaborate with RUW in supporting this remarkable technology-focused event. It highlights our commitment to social responsibility, and our ongoing efforts to enhance the digital and innovation capabilities of young Bahraini women and foster their ability to harness technological tools in the service of a smarter, more sustainable future.”

For his part, Dr. Humam ElAgha, Acting Dean of the College of Engineering and Technology at the University, said: “BuildHer CityHack 2025 embodies our hands-on approach to education. By tackling real-world problems through creative thinking and sustainable solutions, we're preparing women to thrive in the knowledge economy – a cornerstone of the University's vision.”

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!