-

Cohort 8 of the ‘Raise’ Programme Launches with 11 Startups

Spring Venture Services has launched Cohort 8 of “Raise: The Art of Fundraising”, a two-week intensive bootcamp designed to equip startup founders with the skills and knowledge needed to secure investment and scale their businesses. The programme is supported by The Labour Fund (Tamkeen) to prepare startups pitching at the ongoing StartUp Bahrain Pitch Series. The programme is facilitated by Spring Venture Services, and global venture capital firm Salica Investments, providing founders with capital, expert in-house capability, and access to MENA’s leading investors to increase the likelihood of startup success.

Since its inception, “Raise” has successfully conducted seven bootcamps in preparation for 15 StartUp Bahrain Pitch events, helping 104 startups refine their investor readiness and secure essential funding. The programme provides entrepreneurs with hands-on workshops, fireside chats, and one-on-one office hours, ensuring they gain a strong foundation in fundraising, pitching, and business strategy.

A key highlight of the programme is the StartUp Bahrain Pitch Series, where participating startups will have the opportunity to showcase their businesses before an esteemed panel of judges and an influential audience. These events are organised in collaboration with key industry stakeholders, including the Ministry of Industry & Commerce, the Labour Fund (Tamkeen), Bahrain Economic Development Board, and Bahrain Development Bank (BDB), and StartUp Bahrain. The events conclude with the announcement of the winning startup, which receives a cash prize deployed against key milestones, along with potential further funding and support from programme partners.

The participating startups in Cohort 8, categorized by industry, are:

Technology & AI

DOO is an AI-powered platform that enhances customer engagement, offering businesses an efficient way to personalize their customer interactions and streamline their services. Tamam provides an AI-driven order management system designed to help small businesses optimize their operations and manage orders effectively. Croozz Technologies introduces a telematics-based solution that rewards safe driving, encouraging responsible driving habits through real-time tracking and incentives.

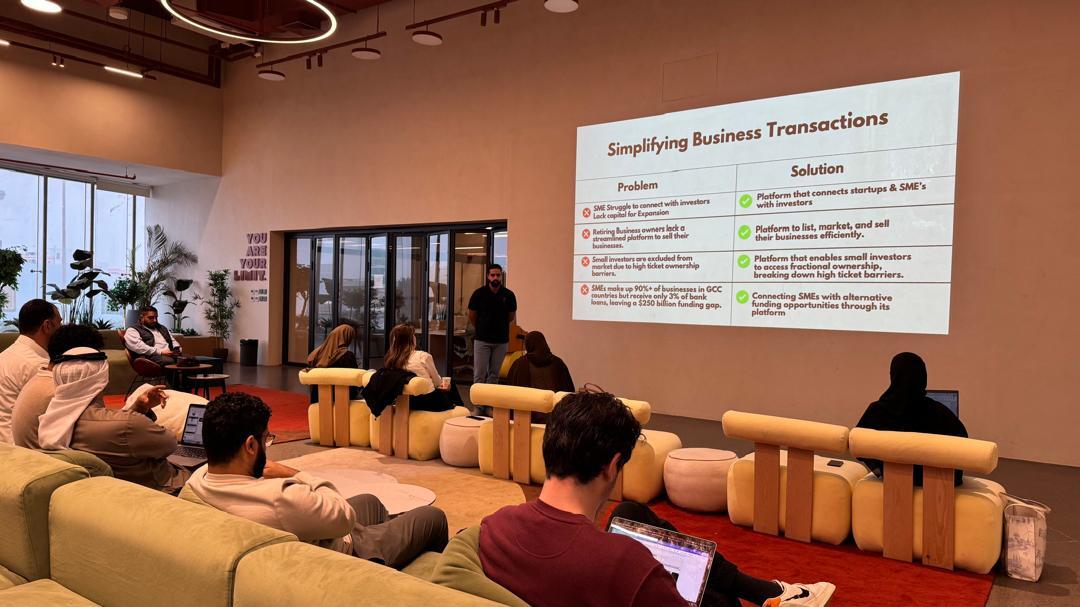

Marketplace & E-commerce

BizBay is a digital marketplace that connects businesses for buying, selling, and investing, facilitating seamless transactions and growth opportunities. Cardue offers a platform for digital car care services, simplifying vehicle maintenance and repairs with on-demand service options. Ihdaa redefines gifting by integrating charitable donations, allowing users to send thoughtful gifts while supporting worthy causes.

Finance & Business Services

Safer provides innovative travel financing solutions, making it easier for individuals to plan and fund their trips. Rentat offers a digital solution for property management, automating tasks and streamlining processes for property owners and tenants alike.

Consumer & Lifestyle

Clany specializes in managing esports events, creating a platform that helps organizers execute successful and engaging competitions. Jalees offers an on-demand childcare platform, connecting parents with trusted caregivers for flexible childcare services. Seera provides a meal subscription service that supports local vendors, offering customers convenient meal options while helping food entrepreneurs thrive.

The Raise bootcamp continues to play a crucial role in fostering a strong entrepreneurial ecosystem by providing startups with access to key industry leaders, investors, and potential partners.

You May Also Like

Popular Posts

Caricature

BENEFIT Sponsors BuildHer...

- April 23, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, has sponsored the BuildHer CityHack 2025 Hackathon, a two-day event spearheaded by the College of Engineering and Technology at the Royal University for Women (RUW).

Aimed at secondary school students, the event brought together a distinguished group of academic professionals and technology experts to mentor and inspire young participants.

More than 100 high school students from across the Kingdom of Bahrain took part in the hackathon, which featured an intensive programme of training workshops and hands-on sessions. These activities were tailored to enhance participants’ critical thinking, collaborative problem-solving, and team-building capabilities, while also encouraging the development of practical and sustainable solutions to contemporary challenges using modern technological tools.

BENEFIT’s Chief Executive Mr. Abdulwahed AlJanahi, commented: “Our support for this educational hackathon reflects our long-term strategic vision to nurture the talents of emerging national youth and empower the next generation of accomplished female leaders in technology. By fostering creativity and innovation, we aim to contribute meaningfully to Bahrain’s comprehensive development goals and align with the aspirations outlined in the Kingdom’s Vision 2030—an ambition in which BENEFIT plays a central role.”

Professor Riyadh Yousif Hamzah, President of the Royal University for Women, commented: “This initiative reflects our commitment to advancing women in STEM fields. We're cultivating a generation of creative, solution-driven female leaders who will drive national development. Our partnership with BENEFIT exemplifies the powerful synergy between academia and private sector in supporting educational innovation.”

Hanan Abdulla Hasan, Senior Manager, PR & Communication at BENEFIT, said: “We are honoured to collaborate with RUW in supporting this remarkable technology-focused event. It highlights our commitment to social responsibility, and our ongoing efforts to enhance the digital and innovation capabilities of young Bahraini women and foster their ability to harness technological tools in the service of a smarter, more sustainable future.”

For his part, Dr. Humam ElAgha, Acting Dean of the College of Engineering and Technology at the University, said: “BuildHer CityHack 2025 embodies our hands-on approach to education. By tackling real-world problems through creative thinking and sustainable solutions, we're preparing women to thrive in the knowledge economy – a cornerstone of the University's vision.”

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!