-

Syrian regime detains security officer involved in Tadamon massacre

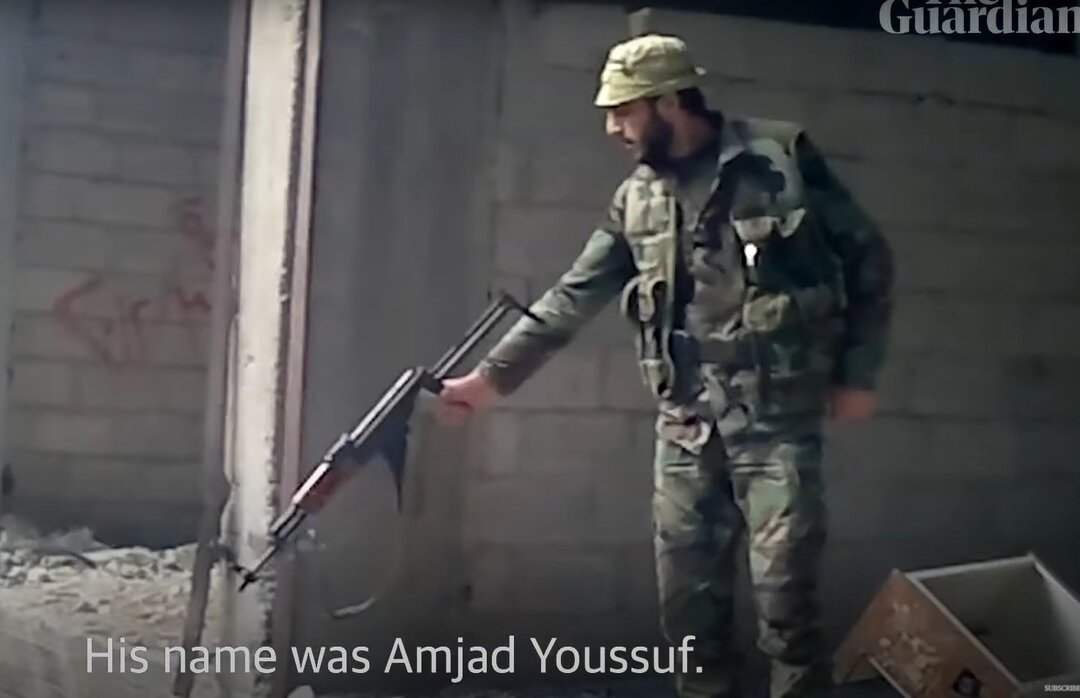

A report issued Monday (May 30) by the Syrian Network for Human Rights said that the Syrian regime detained Amjad Youssef, an officer in the Syrian security forces, who massacred dozens of Syrians and raped dozens of women in the Tadamon neighborhood in Damascus.

The Network said: “The Syrian regime is now keeping Youssef in custody."

However, it added that the detention process was not carried out according to a judicial warrant based on a specific charge, explaining that Youssef has not been referred to the judiciary and that the Syrian regime has not issued any information indicating his arrest.

At the end of April 2022, New Lines, a magazine specialized in the Middle East affairs, published an investigation revealing that Youssef was working for Military Intelligence’s District Branch, also known as Branch 227 and was responsible for the arrest, torture and killing of thousands in the Tadamon neighborhood. He had confessed to the mass killing.

A hidden war crime: footage sheds light on horrors of war in Syria – video explainer https://t.co/3PBRS8Dx67

— The Guardian (@guardian) April 27, 2022

Fadel Abdul Ghany, founder and chairman of the Syrian Network for Human Rights, told Asharq Al-Awsat that the Syrian regime would not have detained Amjad Youssef if regime bodies had not been involved in this atrocity at the highest levels.

He said the Network received information that the Syrian regime had detained Youssef a month ago, following the publication of his confessions.

The Guardian: Newly revealed video shows a 'hidden war crime' in Syria

Abdul Ghany said: “This reveals that high-ranking regime officials are involved in these crimes and that Youssef is just a small part of an integrated system."

He said the regime fears that more of those involved in similar crimes will be exposed, and, for this end, the regime might hide Amjad for life or kill him after he confessed his offenses.

Abdul Ghany also said that the regime did not arrest any security services involved in committing similar atrocious violations nor did it hold anyone accountable.

The French intelligence officer Énora Chame talks about her book on Syria

He said: “The Syrian regime protects violators, and in some cases promotes them, so that they’re aware that their own fate is always linked to the regime’s fate, and defending it becomes an essential part of defending themselves."

According to the Network’s report, the Syrian regime has systematically used enforced disappearance as one of its most prominent tools of repression and terrorism aimed at crushing and annihilating political opponents simply for expressing their opinion.

It said Youssef and thousands of other members of the regime’s security services and army forces would not have committed such atrocious violations had they not been part of a deliberate policy implemented at the direct orders of Assad.

Syria rejects Erdogan's plan to return million refugees to 'safe zone'

The report called on the UN Security Council to hold an emergency meeting to discuss the fate of the forcibly disappeared persons in Syria and to act to end torture and deaths inside Syrian regime detention centers.

The Syrian Network report also raised concern over the fate of 87,000 people documented as being forcibly disappeared in regime prisons, which may be similar to that suffered by the victims in al Tadamun neighborhood.

It showed that the Syrian regime has detained, and continues to detain, at least 131,469 of the people arrested since March 2011, with 86,792 of this number classified as forcibly disappeared persons, including 1,738 children and 4,986 women.

Source: aawsat

You May Also Like

Popular Posts

Caricature

BENEFIT AGM approves 10%...

- March 27, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, held its Annual General Meeting (AGM) at the company’s headquarters in the Seef District.

During the meeting, shareholders approved all items listed on the agenda, including the ratification of the minutes of the previous AGM held on 26 March 2024. The session reviewed and approved the Board’s Annual Report on the company’s activities and financial performance for the fiscal year ended 31 December 2024, and the shareholders expressed their satisfaction with the company’s operational and financial results during the reporting period.

The meeting also reviewed the Independent External Auditor’s Report on the company’s consolidated financial statements for the year ended 31 December 2024. Subsequently, the shareholders approved the audited financial statements for the fiscal year. Based on the Board’s recommendation, the shareholders approved the distribution of a cash dividend equivalent to 10% of the paid-up share capital.

Furthermore, the shareholders endorsed the allocation of a total amount of BD 172,500 as remuneration to the members of the Board for the year ended 31 December 2024, subject to prior clearance by related authorities.

The extension of the current composition of the Board was approved, which includes ten members and one CBB observer, for a further six-month term, expiring in September 2025, pending no objection from the CBB.

The meeting reviewed and approved the Corporate Governance Report for 2024, which affirmed the company’s full compliance with the corporate governance directives issued by the CBB and other applicable regulatory frameworks. The AGM absolved the Board Members of liability for any of their actions during the year ending on 31st December 2024, in accordance with the Commercial Companies Law.

In alignment with regulatory requirements, the session approved the reappointment of Ernst & Young (EY) as the company’s External Auditors for the fiscal year 2025, covering both the parent company and its subsidiaries—Sinnad and Bahrain FinTech Bay. The Board was authorised to determine the external auditors’ professional fees, subject to approval from the CBB, and the meeting concluded with a discussion of any additional issues as per Article (207) of the Commercial Companies Law.

Speaking on the company’s performance, Mr. Mohamed Al Bastaki, Chairman BENEFIT , stated: “In terms of the financial results for 2024, I am pleased to say that the year gone by has also been proved to be a success in delivering tangible results. Growth rate for 2024 was 19 per cent. Revenue for the year was BD 17 M (US$ 45.3 Million) and net profit was 2 Million ($ 5.3 Million).

Mr. Al Bastaki also announced that the Board had formally adopted a new three-year strategic roadmap to commence in 2025. The strategy encompasses a phased international expansion, optimisation of internal operations, enhanced revenue diversification, long-term sustainability initiatives, and the advancement of innovation and digital transformation initiatives across all service lines.

“I extend my sincere appreciation to the CBB for its continued support of BENEFIT and its pivotal role in fostering a stable and progressive regulatory environment for the Kingdom’s banking and financial sector—an environment that has significantly reinforced Bahrain’s standing as a leading financial hub in the region,” said Mr. Al Bastaki. “I would also like to thank our partner banks and valued customers for their trust, and our shareholders for their ongoing encouragement. The achievements of 2024 set a strong precedent, and I am confident they will serve as a foundation for yet another successful and impactful year ahead.”

Chief Executive of BENEFIT; Mr. Abdulwahed AlJanahi commented, “The year 2024 represented another pivotal chapter in BENEFIT ’s evolution. We achieved substantial progress in advancing our digital strategy across multiple sectors, while reinforcing our long-term commitment to the development of Bahrain’s financial services and payments landscape. Throughout the year, we remained firmly aligned with our objective of delivering measurable value to our shareholders, strategic partners, and customers. At the same time, we continued to play an active role in enabling Bahrain’s digital economy by introducing innovative solutions and service enhancements that directly address market needs and future opportunities.”

Mr. AlJanahi affirmed that BENEFIT has successfully developed a robust and well-integrated payment network that connects individuals and businesses across Bahrain, accelerating the adoption of emerging technologies in the banking and financial services sector and reinforcing Bahrain’s position as a growing fintech hub, and added, “Our achievements of the past year reflect a long-term vision to establish a resilient electronic payment infrastructure that supports the Kingdom’s digital economy. Key developments in 2024 included the implementation of central authentication for open banking via BENEFIT Pay”

Mr. AlJanahi concluded by thanking the Board for its strategic direction, the company’s staff for their continued dedication, and the Central Bank of Bahrain, member banks, and shareholders for their valuable partnership and confidence in the company’s long-term vision.

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!