-

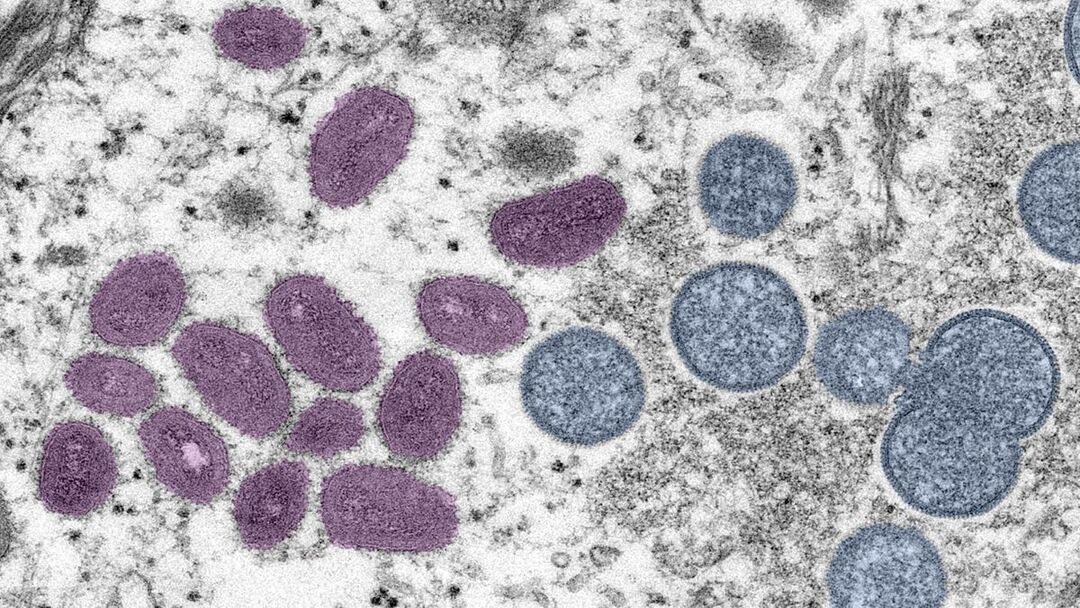

First case of human-to-dog transmission of monkeypox reported, WHO urges caution

The World Health Organization reported Wednesday (August 17) the first case of human-to-dog transmission of monkeypox, urging infected people to avoid exposing animals to the virus.

The case reported last week in the medical journal The Lancet was between two men and their Italian greyhound living together in Paris.

Rosamund Lewis, the WHO’s technical lead for monkeypox, told reporters: “This is the first case reported of human-to-animal transmission... and we believe it is the first instance of a canine being infected.”

Experts, she said, had been aware of the theoretical risk that such a jump could happen, and that public health agencies had already been advising those suffering from the disease to “isolate from their pets.”

In addition, she said “waste management is critical” to lower the risk of contaminating rodents and other animals outside the household.

It was vital, she said, for people to “have information on how to protect their pets, as well as how to manage their waste so that animals in general are not exposed to the monkeypox virus.”

When viruses jump the species barrier it often sparks concern that they could mutate in a more dangerous direction, the AFP reported, the Arab news said.

Lewis stressed that so far there was no reports that was happening with monkeypox.

But, she acknowledged, “certainly as soon as the virus moves into a different setting in a different population, there is obviously a possibility that it will develop differently and mutate differently.”

WHO turns to public for monkeypox name change

The main concern revolves around animals outside of the household.

“The more dangerous situation... is where a virus can move into a small mammal population with high density of animals,” WHO emergencies director Michael Ryan told reporters.

“It is through the process of one animal infecting the next and the next and the next that you see rapid evolution of the virus.”

He stressed though that there was little cause for concern around household pets.

US announces monkeypox public health emergency

“I don’t expect the virus to evolve any more quickly in one single dog than in one single human,” he said, adding that while “we need to remain vigilant... pets are not a risk.”

Monkeypox received its name because the virus was originally identified in monkeys kept for research in Denmark in 1958, but the disease is found in a number of animals, and most frequently in rodents.

The disease was first discovered in humans in 1970 in the Democratic Republic of Congo, with the spread since then mainly limited to certain West and Central African countries.

Brazil to treat severe monkeypox cases with antiviral drug Tecovirimat

But in May, cases of the disease, which causes fever, muscular aches and large boil-like skin lesions, began spreading rapidly around the world, mainly among men who have sex with men.

Worldwide, more than 35,000 cases have been confirmed since the start of the year in 92 countries, and 12 people have died, according to the WHO, which has designated the outbreak a global health emergency.

Source: arabnews

You May Also Like

Popular Posts

Caricature

BENEFIT AGM approves 10%...

- March 27, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, held its Annual General Meeting (AGM) at the company’s headquarters in the Seef District.

During the meeting, shareholders approved all items listed on the agenda, including the ratification of the minutes of the previous AGM held on 26 March 2024. The session reviewed and approved the Board’s Annual Report on the company’s activities and financial performance for the fiscal year ended 31 December 2024, and the shareholders expressed their satisfaction with the company’s operational and financial results during the reporting period.

The meeting also reviewed the Independent External Auditor’s Report on the company’s consolidated financial statements for the year ended 31 December 2024. Subsequently, the shareholders approved the audited financial statements for the fiscal year. Based on the Board’s recommendation, the shareholders approved the distribution of a cash dividend equivalent to 10% of the paid-up share capital.

Furthermore, the shareholders endorsed the allocation of a total amount of BD 172,500 as remuneration to the members of the Board for the year ended 31 December 2024, subject to prior clearance by related authorities.

The extension of the current composition of the Board was approved, which includes ten members and one CBB observer, for a further six-month term, expiring in September 2025, pending no objection from the CBB.

The meeting reviewed and approved the Corporate Governance Report for 2024, which affirmed the company’s full compliance with the corporate governance directives issued by the CBB and other applicable regulatory frameworks. The AGM absolved the Board Members of liability for any of their actions during the year ending on 31st December 2024, in accordance with the Commercial Companies Law.

In alignment with regulatory requirements, the session approved the reappointment of Ernst & Young (EY) as the company’s External Auditors for the fiscal year 2025, covering both the parent company and its subsidiaries—Sinnad and Bahrain FinTech Bay. The Board was authorised to determine the external auditors’ professional fees, subject to approval from the CBB, and the meeting concluded with a discussion of any additional issues as per Article (207) of the Commercial Companies Law.

Speaking on the company’s performance, Mr. Mohamed Al Bastaki, Chairman BENEFIT , stated: “In terms of the financial results for 2024, I am pleased to say that the year gone by has also been proved to be a success in delivering tangible results. Growth rate for 2024 was 19 per cent. Revenue for the year was BD 17 M (US$ 45.3 Million) and net profit was 2 Million ($ 5.3 Million).

Mr. Al Bastaki also announced that the Board had formally adopted a new three-year strategic roadmap to commence in 2025. The strategy encompasses a phased international expansion, optimisation of internal operations, enhanced revenue diversification, long-term sustainability initiatives, and the advancement of innovation and digital transformation initiatives across all service lines.

“I extend my sincere appreciation to the CBB for its continued support of BENEFIT and its pivotal role in fostering a stable and progressive regulatory environment for the Kingdom’s banking and financial sector—an environment that has significantly reinforced Bahrain’s standing as a leading financial hub in the region,” said Mr. Al Bastaki. “I would also like to thank our partner banks and valued customers for their trust, and our shareholders for their ongoing encouragement. The achievements of 2024 set a strong precedent, and I am confident they will serve as a foundation for yet another successful and impactful year ahead.”

Chief Executive of BENEFIT; Mr. Abdulwahed AlJanahi commented, “The year 2024 represented another pivotal chapter in BENEFIT ’s evolution. We achieved substantial progress in advancing our digital strategy across multiple sectors, while reinforcing our long-term commitment to the development of Bahrain’s financial services and payments landscape. Throughout the year, we remained firmly aligned with our objective of delivering measurable value to our shareholders, strategic partners, and customers. At the same time, we continued to play an active role in enabling Bahrain’s digital economy by introducing innovative solutions and service enhancements that directly address market needs and future opportunities.”

Mr. AlJanahi affirmed that BENEFIT has successfully developed a robust and well-integrated payment network that connects individuals and businesses across Bahrain, accelerating the adoption of emerging technologies in the banking and financial services sector and reinforcing Bahrain’s position as a growing fintech hub, and added, “Our achievements of the past year reflect a long-term vision to establish a resilient electronic payment infrastructure that supports the Kingdom’s digital economy. Key developments in 2024 included the implementation of central authentication for open banking via BENEFIT Pay”

Mr. AlJanahi concluded by thanking the Board for its strategic direction, the company’s staff for their continued dedication, and the Central Bank of Bahrain, member banks, and shareholders for their valuable partnership and confidence in the company’s long-term vision.

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!