-

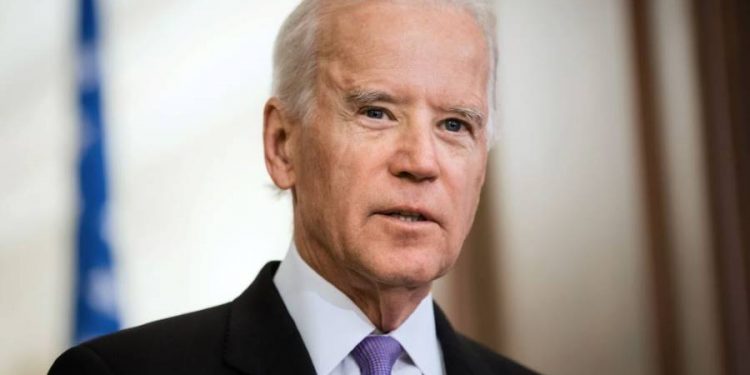

Biden administration expected to renounce sanctions on Bashar al-Assad

The Washington Free Beacon reported according to congressional sources that the Biden administration is expected to waive sanctions on Syrian strongman Bashar al-Assad to facilitate an energy deal with Hezbollah-controlled Lebanon.

According to the Washington Free Beacon, the administration wants to waive portions of the bipartisan Caesar Act, which applied wide-ranging sanctions on Assad for his war crimes in Syria, to facilitate an energy deal with Arab nations that would provide the Assad regime with a financial and political lifeline.

Congressional sources told the Washington Free Beacon that Brett McGurk, the White House coordinator for the Middle East and North Africa who was caught having an extramarital affair with a reporter in 2008 while serving as the Obama administration's ambassadorial nominee to Iraq, is pressing Egypt to sell gas to Lebanon via a pipeline that runs through Syria.

The Biden administration would have to waive key sanctions on Assad in order for the deal to go through.

The the Washington Free Beacon said that as Biden and Democrats in Congress signal a willingness to back sanctions relief, Republican foreign policy leaders say removing sanctions on Assad will embolden his Iranian backers as well as Hezbollah. Indeed, Hezbollah itself sees the deal as a victory in its fight against U.S. sanctions and efforts to expand the Islamic Republic's influence across the Middle East, saying it will loosen restrictions on all three countries involved: Syria, Iran, and Lebanon.

Joe Wilson, a House Foreign Affairs Committee member and chair of the Republican Study Committee's National Security and Foreign Affairs Task Force, told the Free Beacon: "Why in the world would the Biden administration lift sanctions on one of the most brutal human rights abusers in the world—the Assad regime?"

According to a congressional source, the deal will supply the Assad regime with much-needed hard cash.

Read more: Syrian regime forces enter Daraa under ceasefire deal brokered by Russia

The source said: "Assad is desperate for hard currency and that's what they are going to get from this via the transit fees."

The Washington Free Beacon mentioned, diplomats from Lebanon, Syria, and Jordan met on Wednesday to finalize a roadmap for the energy deal and have signaled the Biden administration is prepared to issue the necessary waiver.

Dorothy Shea, the U.S. ambassador to Lebanon said she has also been in contact with the White House and Treasury Department as part of efforts to waive sanctions.

"There is a will to make this happen," Shea said in an interview with Al Arabiya English last month. "There will be some logistical things that need to happen too, but I think that it will all fall into place fairly easily."

The Washington Free Beacon added that Sen. Chris Van Hollen (D., Md.), during a trip last week to Lebanon, signaled his party's willingness to back sanctions relief for Assad.

Van Hollen said of the energy deal: "The complication as you know is the transport via Syria."

Read more: Ebrahim Raisi warns West of IAEA move as U.S says time running out to save nuclear deal

He added, "We are

Shea and other Biden administration diplomats believe the energy deal will weaken Iran and Hezbollah because Lebanon would receive energy shipments through Syria instead of Tehran.

But top Hezbollah officials refute this argument. A senior Hezbollah official gloated about the deal after Shea claimed it would undermine the terror group's grip on Lebanon.

The Washington Free Beacon noted that the Biden administration began laying the groundwork for bypassing the Caesar Act in June when it removed sanctions on several businessmen tied to the Iran-Assad financial network.

Source: Washington Free Beacon

You May Also Like

Popular Posts

Caricature

BENEFIT Sponsors BuildHer...

- April 23, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, has sponsored the BuildHer CityHack 2025 Hackathon, a two-day event spearheaded by the College of Engineering and Technology at the Royal University for Women (RUW).

Aimed at secondary school students, the event brought together a distinguished group of academic professionals and technology experts to mentor and inspire young participants.

More than 100 high school students from across the Kingdom of Bahrain took part in the hackathon, which featured an intensive programme of training workshops and hands-on sessions. These activities were tailored to enhance participants’ critical thinking, collaborative problem-solving, and team-building capabilities, while also encouraging the development of practical and sustainable solutions to contemporary challenges using modern technological tools.

BENEFIT’s Chief Executive Mr. Abdulwahed AlJanahi, commented: “Our support for this educational hackathon reflects our long-term strategic vision to nurture the talents of emerging national youth and empower the next generation of accomplished female leaders in technology. By fostering creativity and innovation, we aim to contribute meaningfully to Bahrain’s comprehensive development goals and align with the aspirations outlined in the Kingdom’s Vision 2030—an ambition in which BENEFIT plays a central role.”

Professor Riyadh Yousif Hamzah, President of the Royal University for Women, commented: “This initiative reflects our commitment to advancing women in STEM fields. We're cultivating a generation of creative, solution-driven female leaders who will drive national development. Our partnership with BENEFIT exemplifies the powerful synergy between academia and private sector in supporting educational innovation.”

Hanan Abdulla Hasan, Senior Manager, PR & Communication at BENEFIT, said: “We are honoured to collaborate with RUW in supporting this remarkable technology-focused event. It highlights our commitment to social responsibility, and our ongoing efforts to enhance the digital and innovation capabilities of young Bahraini women and foster their ability to harness technological tools in the service of a smarter, more sustainable future.”

For his part, Dr. Humam ElAgha, Acting Dean of the College of Engineering and Technology at the University, said: “BuildHer CityHack 2025 embodies our hands-on approach to education. By tackling real-world problems through creative thinking and sustainable solutions, we're preparing women to thrive in the knowledge economy – a cornerstone of the University's vision.”

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!