-

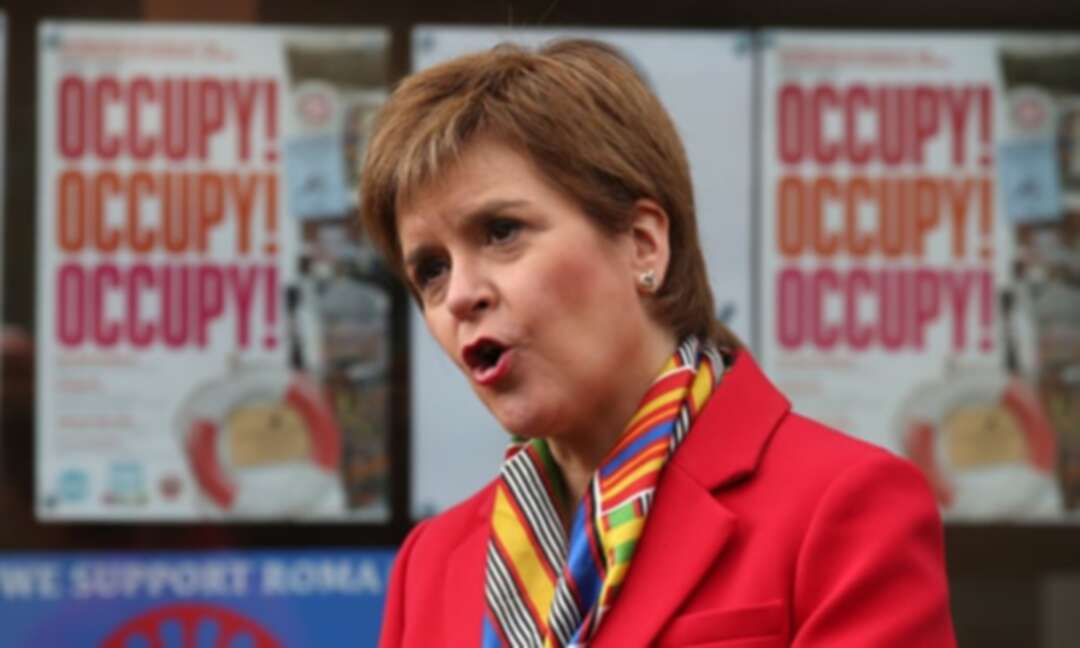

Westminster would not block IndyRef2 if Holyrood in favour, says Sturgeon

SNP leader says government accepts it cannot stop referendum if there is majority for independence in Scottish elections

The UK government accepts that if there is a majority for independence in May’s Holyrood elections it cannot continue to stand in the way of a second independence referendum, Nicola Sturgeon has suggested.

Speaking to members of the Scottish Parliamentary Journalists’ Association, the SNP leader and first minister said: “I strongly suspect, based on some of what I hear that is under discussion in the depths of the Tory party and Whitehall at the moment, that they know an independence referendum is coming.”

Boris Johnson has consistently said he will refuse any request for the transfer of powers necessary to hold a second referendum to Holyrood, regardless of whether the SNP wins an overall majority or forms a government with the pro-independence Greens on 6 May.

Sturgeon added: “That’s why a lot of the talk coming out of those quarters right now is about how they would start to think about rigging the question or rigging the franchises, if there’s a majority for an independence referendum.”

Asked what her position would be if Johnson refused the requisite powers again, she said: “We would take the legislation through Holyrood and if Boris Johnson wanted to stop that he would presumably have to try to legally challenge that, in which case we would vigorously defend our position. But that would be an absurd position for a prime minister to get himself into in the face of a democratic majority.”

Sturgeon has already ruled out any post-election arrangement with Alex Salmond’s newly-formed Alba party, which he claims could help secure a pro-independence “super-majority” by picking up votes on the regional lists from SNP supporters.

Describing the term as “daft rhetoric”, Sturgeon said: “Can we knock on the head this idea for some requirement for a ‘super-majority’. What is needed is a simple majority of MSPs who back a referendum.”

Dismissing Salmond’s recently suggested tactics of legal action, mass demonstrations or unauthorised plebiscites as “not credible”, she went on: “The way we overcome Westminster opposition to a referendum, helpfully, is also the way we win the referendum, which is continuing to persuade people, to win people’s confidence and trust, and build that majority support for independence.”

“That’s what the SNP under my leadership has actually been doing over the past couple of years. We now have a situation where a bad poll for yes is one that shows yes support at or slightly above 50%. That’s a pretty good sign of progress.”

She added that, while she understood the appeal of alternative routes to those who wanted independence as quickly as possible, “my job and my duty as SNP leader and as first minister is not just to tell people the easy things that they want to hear”.

source: Libby Brooks

Levant

You May Also Like

Popular Posts

Caricature

BENEFIT Sponsors BuildHer...

- April 23, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, has sponsored the BuildHer CityHack 2025 Hackathon, a two-day event spearheaded by the College of Engineering and Technology at the Royal University for Women (RUW).

Aimed at secondary school students, the event brought together a distinguished group of academic professionals and technology experts to mentor and inspire young participants.

More than 100 high school students from across the Kingdom of Bahrain took part in the hackathon, which featured an intensive programme of training workshops and hands-on sessions. These activities were tailored to enhance participants’ critical thinking, collaborative problem-solving, and team-building capabilities, while also encouraging the development of practical and sustainable solutions to contemporary challenges using modern technological tools.

BENEFIT’s Chief Executive Mr. Abdulwahed AlJanahi, commented: “Our support for this educational hackathon reflects our long-term strategic vision to nurture the talents of emerging national youth and empower the next generation of accomplished female leaders in technology. By fostering creativity and innovation, we aim to contribute meaningfully to Bahrain’s comprehensive development goals and align with the aspirations outlined in the Kingdom’s Vision 2030—an ambition in which BENEFIT plays a central role.”

Professor Riyadh Yousif Hamzah, President of the Royal University for Women, commented: “This initiative reflects our commitment to advancing women in STEM fields. We're cultivating a generation of creative, solution-driven female leaders who will drive national development. Our partnership with BENEFIT exemplifies the powerful synergy between academia and private sector in supporting educational innovation.”

Hanan Abdulla Hasan, Senior Manager, PR & Communication at BENEFIT, said: “We are honoured to collaborate with RUW in supporting this remarkable technology-focused event. It highlights our commitment to social responsibility, and our ongoing efforts to enhance the digital and innovation capabilities of young Bahraini women and foster their ability to harness technological tools in the service of a smarter, more sustainable future.”

For his part, Dr. Humam ElAgha, Acting Dean of the College of Engineering and Technology at the University, said: “BuildHer CityHack 2025 embodies our hands-on approach to education. By tackling real-world problems through creative thinking and sustainable solutions, we're preparing women to thrive in the knowledge economy – a cornerstone of the University's vision.”

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!