-

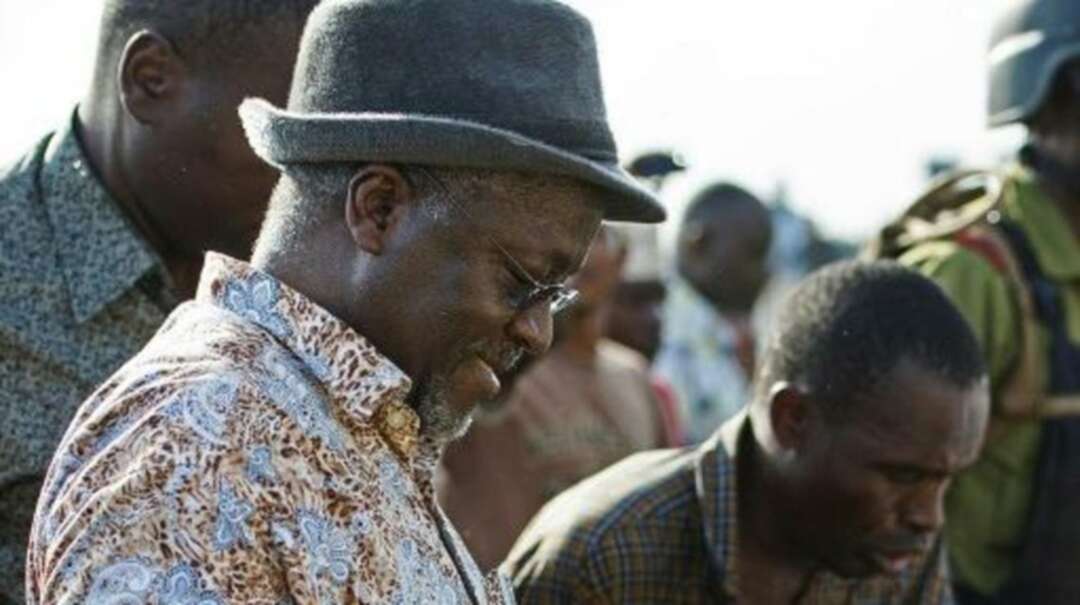

Tanzania’s COVID-19 skeptic leader Magufuli dies of heart disease

Tanzania’s leadership faced calls for a smooth succession on Thursday after President John Magufuli, Africa’s most vehement coronavirus skeptic, died from heart disease following an 18-day absence from public life that drew speculation about his health.

An opposition leader urged the immediate swearing in of vice president Samia Suluhu Hassan as successor, saying that would avoid a constitutional vacuum and prevent uncertainty.

Magufuli’s death, the first of a Tanzanian leader while in office, opens the prospect that the country will gain its first female president.

The constitution says Hassan, 61, should assume the presidency for the remainder of the five-year term that Magufuli began serving last year after winning a second term.

Hassan addressed the nation on television late on Wednesday, saying Magufuli had died from the heart disease that had plagued him for a decade. She said burial arrangements were under way for the 61-year-old leader but did not indicate when she would be sworn in.

Government spokesman Hassan Abbasi did not respond to calls and texts seeking comment on succession plans.

Magufuli had not been seen in public since Feb. 27, sparking rumors he had COVID-19. On March 12, officials denied he had fallen ill and on Monday Hassan had urged Tanzanians not to listen to rumors from outside the country.

As late as Wednesday, she sent ‘greetings’ from Magufuli in a remarks to an audience in the coastal region of Tanga.

“The VP has to be sworn in immediately,” opposition leader Zitto Kabwe told Reuters by phone from Dar es Salaam. “The constitution doesn’t allow a vacuum ... I will be concerned if the day passes without her being sworn in.”

A source who advises businesses operating in Tanzania said “The next 48 hours are crucial ... There is likely to be uncertainty. Some people will want to purge some Magufuli hardliners, but given how he restructured the intelligence services, that is easier said than done.”

Opposition

Nicknamed “The Bulldozer” because of his reputation for pushing through policies despite opposition, Magufuli drew international criticism for his unorthodox and increasingly authoritarian tactics.

Although Hassan publicly championed Magufuli’s leadership style and frequently represented him abroad, she has been more soft spoken and less confrontational than the president.

“The Vice President hasn’t given the impression of significant popularity or influence within the (ruling party),” said Fergus Kell, Africa analyst at the Chatham House think-tank in London. “This could throw up some potential challenges in terms of managing competing interests and generating the required support within the ruling party to govern effectively.”

Magufuli was a vocal COVID-19 skeptic who urged Tanzanians to shun mask-wearing and denounced vaccines as a Western conspiracy, frustrating the World Health Organization.

Traffic moved normally on Thursday morning and there was not a heavy security presence in Dar es Salaam, the country’s biggest city, a Reuters witness said.

Some people stood on street corners in the downtown area reading newspapers including a headline blaring “Grief” and wept. As has been the case throughout the pandemic in Tanzania, many people were not wearing face masks.

Tundu Lissu, Magufuli’s main rival in the October election when the president won a second term, said in an interview with Kenya’s KTN that it was time for the country to open a new chapter after Magufuli “caused havoc to our country.”

East African governments offered condolences, but some people from the region were critical of his stance on COVID-19 and his leadership style. “It has been a horrendous 5 years in #Tanzania,” tweeted Tanzanian lawyer Fatma Karume.

source: Reuters

Image source: AFP

Levant

You May Also Like

Popular Posts

Caricature

BENEFIT Sponsors BuildHer...

- April 23, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, has sponsored the BuildHer CityHack 2025 Hackathon, a two-day event spearheaded by the College of Engineering and Technology at the Royal University for Women (RUW).

Aimed at secondary school students, the event brought together a distinguished group of academic professionals and technology experts to mentor and inspire young participants.

More than 100 high school students from across the Kingdom of Bahrain took part in the hackathon, which featured an intensive programme of training workshops and hands-on sessions. These activities were tailored to enhance participants’ critical thinking, collaborative problem-solving, and team-building capabilities, while also encouraging the development of practical and sustainable solutions to contemporary challenges using modern technological tools.

BENEFIT’s Chief Executive Mr. Abdulwahed AlJanahi, commented: “Our support for this educational hackathon reflects our long-term strategic vision to nurture the talents of emerging national youth and empower the next generation of accomplished female leaders in technology. By fostering creativity and innovation, we aim to contribute meaningfully to Bahrain’s comprehensive development goals and align with the aspirations outlined in the Kingdom’s Vision 2030—an ambition in which BENEFIT plays a central role.”

Professor Riyadh Yousif Hamzah, President of the Royal University for Women, commented: “This initiative reflects our commitment to advancing women in STEM fields. We're cultivating a generation of creative, solution-driven female leaders who will drive national development. Our partnership with BENEFIT exemplifies the powerful synergy between academia and private sector in supporting educational innovation.”

Hanan Abdulla Hasan, Senior Manager, PR & Communication at BENEFIT, said: “We are honoured to collaborate with RUW in supporting this remarkable technology-focused event. It highlights our commitment to social responsibility, and our ongoing efforts to enhance the digital and innovation capabilities of young Bahraini women and foster their ability to harness technological tools in the service of a smarter, more sustainable future.”

For his part, Dr. Humam ElAgha, Acting Dean of the College of Engineering and Technology at the University, said: “BuildHer CityHack 2025 embodies our hands-on approach to education. By tackling real-world problems through creative thinking and sustainable solutions, we're preparing women to thrive in the knowledge economy – a cornerstone of the University's vision.”

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!