-

French strike against Macron reforms enters day two

A strike that crippled public transport and closed schools across France entered a second day on Friday, with trade unions saying they planned to keep going until President Emmanuel Macron backs down from a planned reform of pensions.

The strike pits Macron, a 41-year-old former investment banker who came to power in 2017 on a promise to open up France’s highly regulated economy, against powerful trade unions who say he is set on dismantling worker protections.

The outcome depends on who blinks first - the unions who risk losing public support if the disruption goes on for too long, or the government which fears voters could side with the unions and blame officials for the standoff.

Macron’s government, along with many ordinary French citizens, have made plans to cope with the strike action through the weekend, but may take a different view on Monday, if the disruption extends into a second week.

Rail workers voted to extend their strike through Friday, while labor unions at the Paris bus and metro operator RATP said their walkout would continue until Monday. Other trade unionists were due to decide early on Friday how long they would keep up the strike.

“We're going to protest for a week at least, and at the end of that week it's the government that’s going to back down,” said 50-year-old Paris transport employee Patrick Dos Santos.

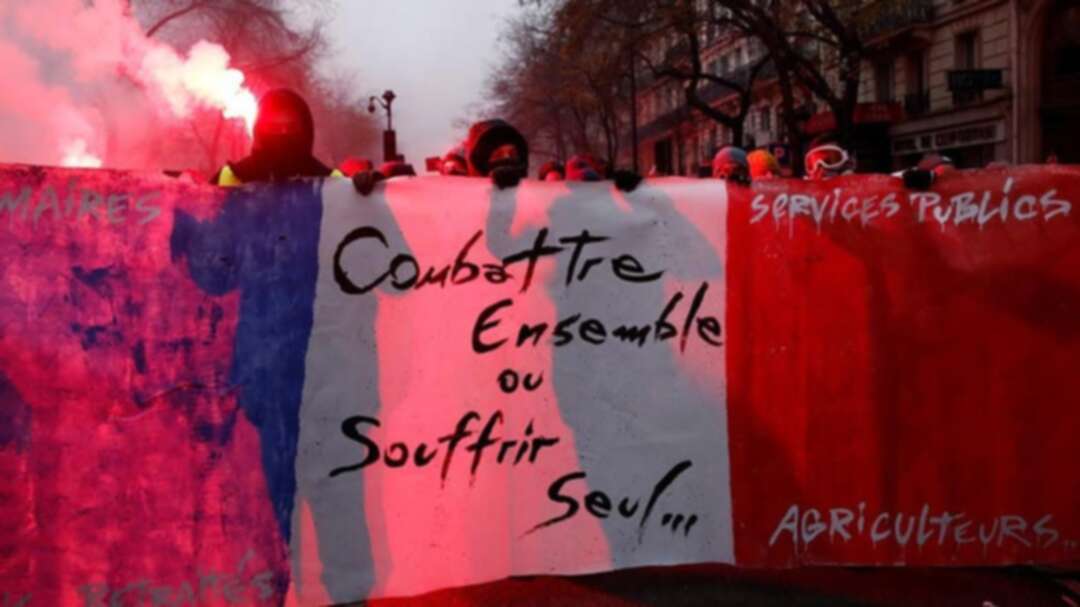

The industrial action already on Thursday brought tens of thousands of protesters into the streets in Paris and forced the closure of parts of the Louvre Museum, home to Leonardo da Vinci's “Mona Lisa”.

High turnout

Union leaders were buoyed by the proportion of healthcare staff, railway workers and teachers who heeded the strike call, and by the numbers who showed up at an anti-government march in Paris and other French cities.

Police said 65,000 marched in Paris, while 806,000 took part in protests nationwide. Union leaders put the numbers higher.

“There’s a noise in the streets, I hope the windows of the Elysee are open,” said Philippe Martinez, secretary-general of the CGT union, referring to the presidential administration.

Police used tear gas in central Paris on Thursday afternoon when protesters on the fringes of the trade unions’ march threw fireworks at officers, ransacked bus stops, and set fire to

rubbish bins.

There were dozens of arrests. Union leaders said those involved in the violence were not affiliated with the trade union movement.

Macron wants to simplify France’s unwieldy pension system, which comprises more than 40 different plans, many with different retirement ages and benefits. Rail workers, mariners and Paris Opera House ballet dancers can retire up to a decade earlier than the average worker.

Macron says the system is unfair and too costly. He wants a single, points-based system under which for each euro contributed, every pensioner has equal rights.

The government has given no indication it will make any climb-down over the central elements of the reform.

But mindful of the anger the subject has generated, Macron’s officials have left themselves scope to make some concessions over the way that the changes will be phased in.

source: Reuters

Tags

You May Also Like

Popular Posts

Caricature

BENEFIT Sponsors BuildHer...

- April 23, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, has sponsored the BuildHer CityHack 2025 Hackathon, a two-day event spearheaded by the College of Engineering and Technology at the Royal University for Women (RUW).

Aimed at secondary school students, the event brought together a distinguished group of academic professionals and technology experts to mentor and inspire young participants.

More than 100 high school students from across the Kingdom of Bahrain took part in the hackathon, which featured an intensive programme of training workshops and hands-on sessions. These activities were tailored to enhance participants’ critical thinking, collaborative problem-solving, and team-building capabilities, while also encouraging the development of practical and sustainable solutions to contemporary challenges using modern technological tools.

BENEFIT’s Chief Executive Mr. Abdulwahed AlJanahi, commented: “Our support for this educational hackathon reflects our long-term strategic vision to nurture the talents of emerging national youth and empower the next generation of accomplished female leaders in technology. By fostering creativity and innovation, we aim to contribute meaningfully to Bahrain’s comprehensive development goals and align with the aspirations outlined in the Kingdom’s Vision 2030—an ambition in which BENEFIT plays a central role.”

Professor Riyadh Yousif Hamzah, President of the Royal University for Women, commented: “This initiative reflects our commitment to advancing women in STEM fields. We're cultivating a generation of creative, solution-driven female leaders who will drive national development. Our partnership with BENEFIT exemplifies the powerful synergy between academia and private sector in supporting educational innovation.”

Hanan Abdulla Hasan, Senior Manager, PR & Communication at BENEFIT, said: “We are honoured to collaborate with RUW in supporting this remarkable technology-focused event. It highlights our commitment to social responsibility, and our ongoing efforts to enhance the digital and innovation capabilities of young Bahraini women and foster their ability to harness technological tools in the service of a smarter, more sustainable future.”

For his part, Dr. Humam ElAgha, Acting Dean of the College of Engineering and Technology at the University, said: “BuildHer CityHack 2025 embodies our hands-on approach to education. By tackling real-world problems through creative thinking and sustainable solutions, we're preparing women to thrive in the knowledge economy – a cornerstone of the University's vision.”

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!